What About Condos?

There is still buying in the downtown core, but the pending and closed sales are not exceeding the number of new listings. This is simply supply and demand. Lets examine further:

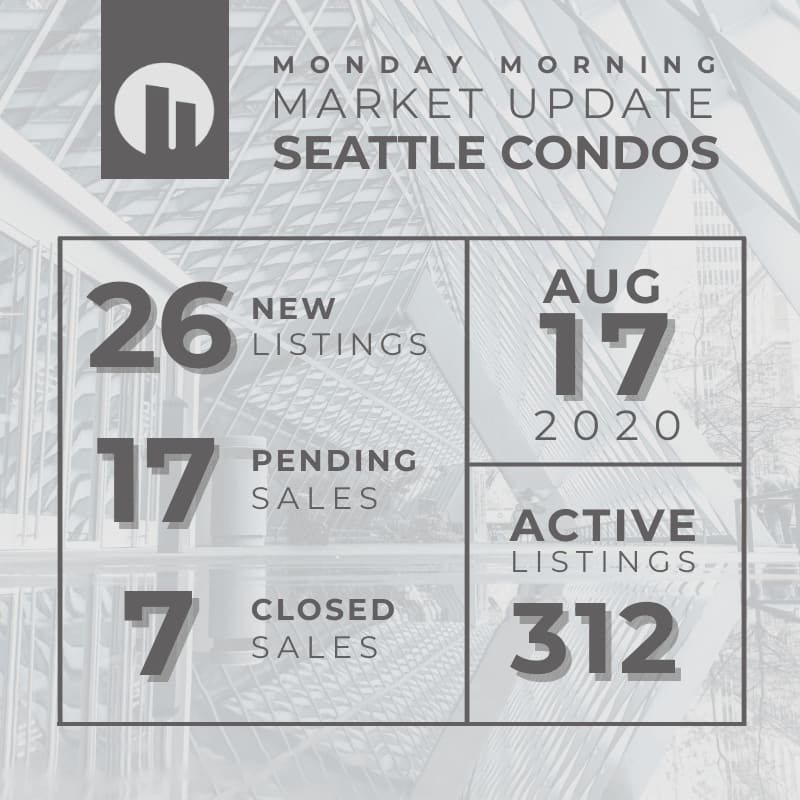

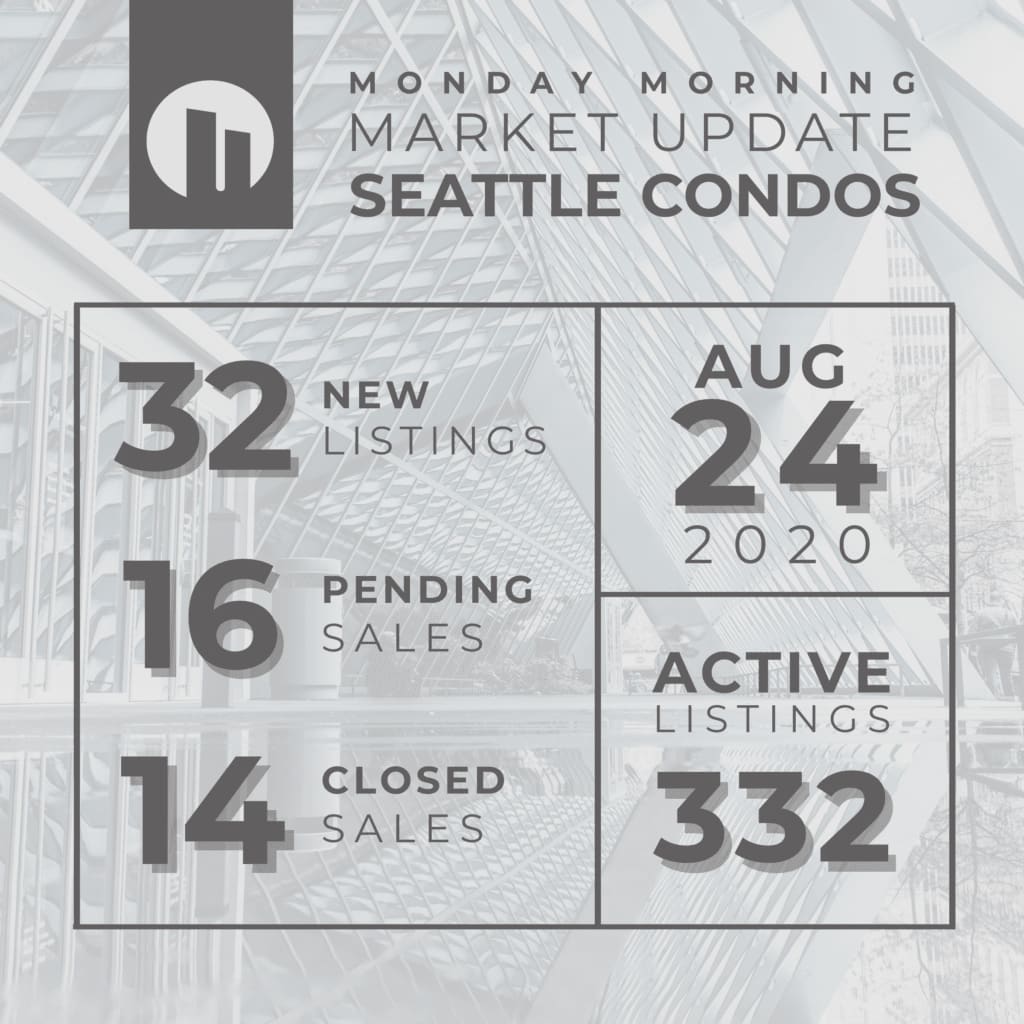

Over the last 30 days, there were 51 condo sales in the downtown Seattle core. If you divide the number of sales (51) by the number of active listings 333, you arrived at 6.5 months of supply. This isn’t terrible, but it indicates a buyers market. It also doesn’t look too bade when you compare it to New York – Did you see my post and video last week?

Interest rates are giving buyers an opportunity to put their money to work. With so much liquidity in the system, the value of the dollar is less. It is important to look at hard assets that are a great inflation hedge. If people will be coming back to the Downtown core for transportation, proximity to hospitals and walkability, one could argue that the time is now to invest. It might not payoff immediately but long term a good investment is made when the majority of investors are looking the other way – just ask Warren Buffett.